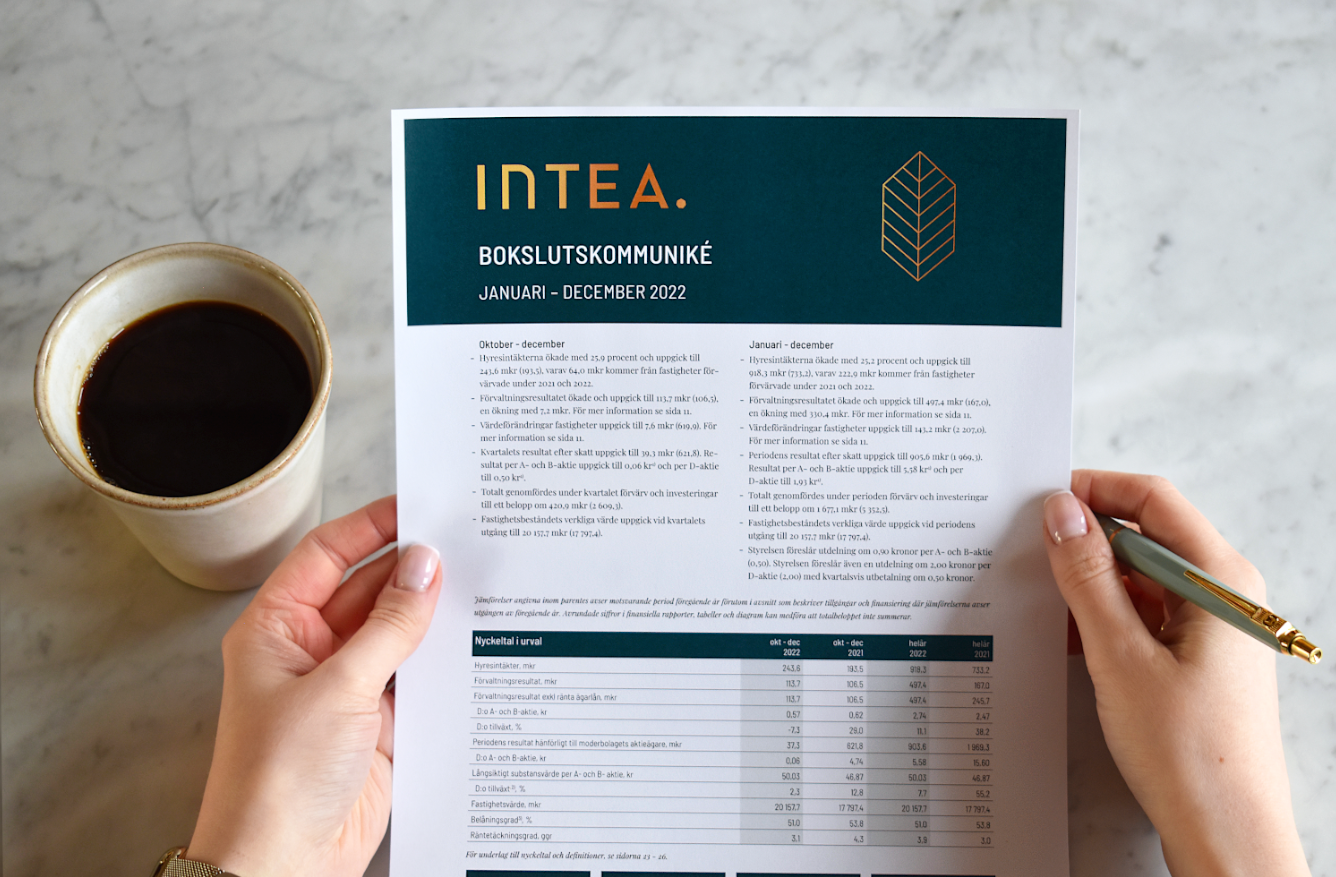

October – December

- Rental income increased by 25.9 percent to SEK 243.6 million (193.5), SEK 64.0 million of which came from properties acquired in 2021 and 2022.

- Profit from property management increased to SEK 113.7 million (106.5), an increase of SEK 7.2 million.

- Changes in the value of properties amounted to SEK 7.6 million (619.9).

- Profit after tax for the quarter amounted to SEK 39.3 million (621.8). Earnings per Class A and Class B share amounted to SEK 0.06 (note 1) and per Class D share SEK 0.50 (note 1).

- Total acquisitions and investments in the quarter amounted to SEK 420.9 million (2,609.3).

- The fair value of the property portfolio at the end of the quarter was SEK 20,157.7 million (17,797.4).

January – December

- Rental income increased by 25.2 percent to SEK 918.3 million (733.2), SEK 222.9 million (2021) of which came from properties acquired in 2021 and 2022.

- Profit from property management increased to SEK 497.4 million (167.0), an increase of SEK 330.4 million.

- Changes in the value of properties amounted to SEK 143.2 million (2,207.0).

- Profit after tax for the period amounted to SEK 905.6 million (1,969.3). Earnings per Class A and Class B share amounted to SEK 5.58 (note 1) and per Class D share SEK 1.93 (note 1).

- Total acquisitions and investments during the period amounted to SEK 1,677.1 million (5,352.5).

- The fair value of the property portfolio at the end of the period was SEK 20,157.7 million (17,797.4).

- The Board of Directors proposes a dividend of SEK 0.90 per Class A and Class B share (0.50). The board also proposes a dividend of SEK 2.00 per Class D share (2.00) with a quarterly payment of SEK 0.50.

1) No diluting instruments exist.

Comparative figures in brackets refer to the corresponding period of the previous year except in the sections describing assets and funding, where comparative figures refer to the end of the previous period. Rounded figures in financial reports, tables and charts may result in the total amount does not add up.

The CEO’s comments

Many negative events during the year have radically changed the playing field for property management companies in Sweden. Naturally, these events have negatively impacted Intea’s operations, which are nevertheless based on a solid foundation. The company continues to adapt its operations to the new market conditions. Despite the deteriorating market situation in the industry, the value of Intea’s property portfolio increased by around 13 percent in 2022 and at year-end exceeded SEK 20 billion for the first time, driven mainly by investments in the project portfolio. Rental income increased by approximately 25 percent and amounted to SEK 918 million. Profit from property management increased by SEK 330 million and amounted to SEK 497 million. The growth in rental income and income from property management was mainly driven by acquisitions.

The new market situation has led to significantly higher costs for property management companies during the year, mainly in terms of financing, where Intea’s average interest rate increased from 1.31 to 2.53 percent during the year. The cost of operating existing buildings has also increased, as have construction costs. The strength of Intea’s defensive assets with long leases with public-sector tenants entails relative advantages in an uncertain market environment. The company’s strategy of stable growth is achieved through carefully selected acquisitions combined with project development of existing and new properties. The strategy remains important to maintain quality and profitable growth in the portfolio, even in an economic downturn.

Four acquisitions were made during the year. In January, the Viskan Prison was acquired in Ånge. In February, an agreement on a 20-year lease was reached with the Prison and Probation Service. The property is currently undergoing renovation and refurbishment, with occupancy expected in early 2025. In March, Intea took possession of the property Jälla 2:25, where specially adapted premises for forensic psychiatry in Uppsala Region are currently under construction. At the beginning of July, Rönneholm Castle, including the Ringsjön prison, was acquired. In September, a majority stake was acquired in a company that owns properties where the University of Skövde and Skövde municipality are tenants.

The company’s projects have had a positive trend during the year. In May, Intea and the Swedish Prison and Probation Service reopened Härnösand Prison. Intea and the Prison and Probation Service have been engaged in the project to reopen the facility since January 2021. The Prison and Probation Service occupies approximately 7,600 sqm under a 15-year lease agreement. During the year, construction also began on a new building for Intea that is being built in wood on the Östersund campus. The project has ambitious sustainability objectives, such as a lower climate footprint than reference buildings and caring for the local environment.

During the year, several new employees joined the Group. The local property management organisations were expanded in Skåne, Vänersborg and Halmstad. In addition, new staff were added to strengthen the central finance team and the sustainability team.

The work to prepare the company for an IPO on Nasdaq Stockholm’s main list is still on hold due to the current market situation.